S ome companies come in and use technology to turn things on their heads. Think Uber for taxi rides and Grub Hub for take out. Here comes a new game changer – Metromile. Metromile is the first and only provider of pay-per-mile car insurance in the US. They launched in Illinois in the spring of 2014 and have been “hard at work to save customers money and create a more informed driving experience for Illinois residents.” Metromile’s per-mile insurance is now available in California, Oregon, Washington, Virginia and Illinois.

ome companies come in and use technology to turn things on their heads. Think Uber for taxi rides and Grub Hub for take out. Here comes a new game changer – Metromile. Metromile is the first and only provider of pay-per-mile car insurance in the US. They launched in Illinois in the spring of 2014 and have been “hard at work to save customers money and create a more informed driving experience for Illinois residents.” Metromile’s per-mile insurance is now available in California, Oregon, Washington, Virginia and Illinois.

According to a recent survey Metromile conducted, Illinois drivers (like me and The Husband) on average only commute 0-10 miles a day! They found that 64% of drivers pay higher premiums to subsidize the minority who drive the most. Metromile thinks that if you drive less, you should pay less for car insurance. Sounds good to me! Right?

Metromile gives you a more “informed driving experience” that helps you save time and money. Designed for those who drive less than 10,000 miles a year, Metromile saves the average customer $500 on car insurance when they switch! Plus, in Illinois, every new customer received 250 bonus miles.

Customers use Metromile Pulse, an OBD-II device to track miles. Drivers only pay a few cents per mile with a low base rate each month for full coverage. Metromile connects your car to your smartphone to offer features including car health information (diagnostic trouble codes), car location, street sweeping alerts and customizable trip logs.

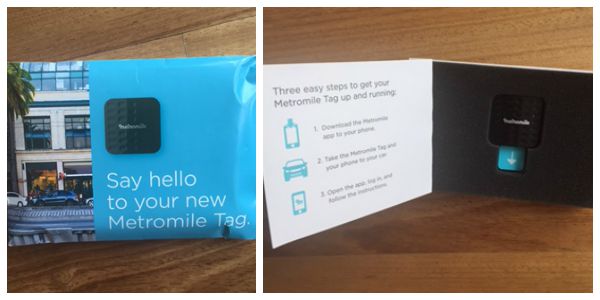

You can also try the Metromile Tag, a free, wireless device for cars that uses Apple’s iBeacon technology to create a more informed driving experience. Metromile Tag connects to the your smartphone via Bluetooth. The consumer and the device are together only when the driver is inside the car. This is available for iOS and Android devices. It helps drivers become more informed about their vehicle and driving behavior with innovative features including:

- Commute optimization

- Find parked location

- Customizable trip logs

- Mileage tracking for expense reporting

- Driving trends

- Street cleaning notifications in select markets

I am an infrequent driver [read: I run more miles per year than I drive.] So, I went online and created a quote. It was super easy. All I needed was my driver’s license information and the basics about my car. The system was able to find The Husband’s details automatically. I then was able to toggle between different features and amounts (deductibles, etc.) to see how much our policy would cost. Since I work from home and take public transportation mostly, we are looking seriously at switching to Metromile. Want to see if Metromile would save you money? Go to the home page and enter your zip code. If your area is covered, you can fill out the form and check out your prices.

Metromile sent me an awesome swag bag of car essentials and a gas card for summer travel. Great news, they will also send one lucky reader a swag bag with an umbrella, t-short, hot/cold travel mug, tire pressure gauge, notebook/pen, mouse pad and much more PLUS a $50 gas card for the lucky reader’s summer travels. Please use the Rafflecopter below to enter. The winner must be a US resident, 18 or over and the offer is void where prohibited. Contest closes August 16th. The winner will be selected and notified on August 18th.

In the mean time, you can check out Metromile online or on Twitter or Facebook.

Do a little math – would this work out better for you??

Please note: I was provided a swag bag and gas gift card in exchange for writing this post and telling you about Metromile. All opinions are my own.