I spoke to a bunch of male friends about their goals and resolutions for 2013 and they all started with a focus on financial planning and careers (whether they need to start exercising or losing the last 5 pounds or not!) – my female friends not so much. For whatever reason, many women choose not to focus on (or even avoid) finances. I personally use the excuse that the husband takes care of all things financial, but that is not really acceptable, is it?

Enter Daily Worth – “the smart woman’s go-to source for everything money-related.” The site was founded by Amanda Steinberg in 2009 to build a trusted platform for women “to learn how to earn, manage and love their money.”

There are three different emails you can get:

> Did you resolve to take charge of your finances this year? Sign up for DailyWorth, you’ll get a few short emails per week that challenge everything you’ve ever thought about money, how you relate to it, and how it can become a positive force in your life. (I am including some great get started tips they sent me for starting a financially health 2013 below!)

> Are you looking to build more net worth? Subscribe to MoreWorth and join a community of like-minded professional women.

> Are you a business owner who wants to overcome challenges and grow? Subscribe to CreateWorth to connect with other women entrepreneurs for expert tips and innovative idea

Tips from Daily Worth to start 2013 right! (Click the links to read the full posts)

Get in great (fiscal) shape for the New Year with their simple four-day Money Fit Plan!

Day 1: Avoid disciplinary action. Set up a 2013 reward system instead. Giving yourself permission to indulge (occasionally) can help you stick to a diet, lining up meaningful incentives can help you to stay motivated around money goals for the coming year.

Day 2: Start with a Vision Take a look at what you make, what you spend and what you save. Then DECIDE how to spend your discretionary monies. Create a spending vision for this year.

Day 3: Make 2013 the year of doing less. It’s easier to do the right thing when you make it easy for yourself. Set up automated deposits to your savings and investments.

Day 4: Become a numbers gal. Know your financial numbers – make a budget, check your savings and portfolios and make a plan!

One last idea for a resolution from Daily Worth, “Become an investor” (or if you’re already a confident investor, resolve to encourage women around you to be the same.)

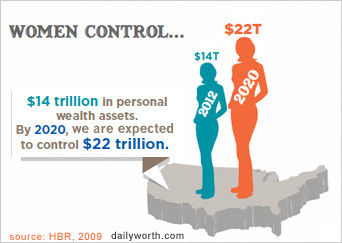

“Did you know? WOMEN will control $22 trillion by 2020, up from $14 trillion today. How? Women are working more. Women are earning more. And many of them will inherit twice—once from their parents and once from their husbands. And yet, according to a survey by MassMutual Financial Group, only 26% of women are confident making their own investment decisions, compared with 44% of men. Women are the future directors of money. How do we make sure that our power—and this opportunity doesn’t go to waste? It’s a big question.*”

This is a tough nut to crack, but good news! In a few weeks, Daily Worth will be launching an investing center. They are also having their first ever (free) e-learning course to help us to better understand our money and give step-by-step instructions for setting up the right investing accounts, automating savings and more.

Check out Daily Worth, ladies (and gents) – what do you have to lose? This could be your year to bone up on your finances – one small step at a time! What are you doing to better manage your money in 2013? Let me know if you have other helpful tips to share!

(*from email on 1/2 that nudged me to write this post!)

PS. This was not solicited by Daily Worth (and I hope that they are cool that I passed along their content!) I just think it is a helpful site with useful, digestible tips that I do read- not an inbox clogger.